Understanding Blockchain Technology in Detail

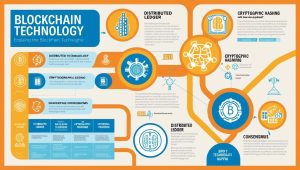

Blockchain is a revolutionary technology designed to enhance security, transparency, and efficiency in data and transaction management. At its core, blockchain is a decentralized digital ledger that records transactions across multiple computers in a way that ensures data integrity and security. Let’s dive into how blockchain works, its components, and its applications in a detailed 3000-word exploration.

1. What is Blockchain?

Blockchain is a distributed ledger technology (DLT) that organizes data into blocks. Each block contains transactional data and is linked to the previous block using cryptography, forming a chain. This structure ensures the integrity of the recorded data because altering one block requires changing all subsequent blocks, a process that is computationally expensive and practically infeasible.

2. Components of Blockchain

A blockchain system consists of several key elements:

- Blocks: Each block includes:

- Previous hash: Links it to the previous block.

- Transaction data: Records the details of transactions.

- Nonce: A random number used in mining to find the target hash.

- Hash: A unique identifier generated through cryptographic algorithms.

- Nodes: Independent computers in the network that maintain a copy of the blockchain. They verify and validate transactions.

- Consensus Mechanisms: Methods to validate and agree upon transactions in the blockchain. Common types include:

- Proof of Work (PoW): Miners solve complex mathematical puzzles (e.g., Bitcoin).

- Proof of Stake (PoS): Validators are selected based on the stake they hold (e.g., Ethereum)【25†source】【26†source】.

3. How Blockchain Works

The blockchain process can be broken down into the following steps:

| Step | Description |

|---|---|

| 1. Transaction Initiation | A user initiates a transaction via a digital wallet. |

| 2. Transaction Broadcast | The transaction is broadcast to the network of nodes. |

| 3. Validation | Nodes validate the transaction based on consensus rules. |

| 4. Block Creation | Validated transactions are grouped into a block. |

| 5. Mining/Validation | Miners or validators confirm the block using consensus mechanisms. |

| 6. Chain Addition | The validated block is added to the blockchain. |

| 7. Confirmation | The transaction is completed and becomes immutable. |

4. Blockchain Transparency and Security

Blockchain is transparent and secure due to its decentralized nature. Every node in the network holds an identical copy of the blockchain, preventing single points of failure. Additionally, transactions are encrypted, and changes require consensus from the majority of nodes, ensuring data integrity【25†source】【27†source】.

Blockchain is transparent and secure due to its decentralized nature. Every node in the network holds an identical copy of the blockchain, preventing single points of failure. Additionally, transactions are encrypted, and changes require consensus from the majority of nodes, ensuring data integrity【25†source】【27†source】.

5. Types of Blockchain

Blockchain can be categorized based on access and functionality:

| Type | Description |

|---|---|

| Public | Open to anyone (e.g., Bitcoin). |

| Private | Restricted access, managed by a single organization. |

| Consortium | Controlled by a group of organizations for collaborative use. |

| Hybrid | Combines features of public and private blockchains for flexibility. |

| Sidechains | Operate parallel to the main blockchain, enhancing scalability and functionality【27†source】. |

6. Blockchain Applications

- Cryptocurrencies: Bitcoin and Ethereum rely on blockchain for secure and transparent transactions.

- Smart Contracts: Automated and self-executing contracts without intermediaries (e.g., Ethereum).

- Supply Chain Management: Tracks goods across the supply chain for enhanced traceability.

- Healthcare: Secure sharing of medical records while maintaining privacy.

- Voting Systems: Ensures tamper-proof and transparent elections【25†source】【26†source】.

7. Challenges of Blockchain

While blockchain offers numerous benefits, it faces challenges:

- Energy Consumption: PoW requires significant computational power, raising sustainability concerns.

- Scalability: Processing large numbers of transactions simultaneously can be difficult.

- Regulatory Issues: Different jurisdictions have varying regulations that can affect blockchain adoption.

- Private Key Security: Losing a private key means losing access to assets【27†source】.

8. Financial Advice

Blockchain technology and cryptocurrencies carry risks. Before investing, consult a financial advisor and understand the technology, associated risks, and market conditions. Diversify your investments and never risk more than you can afford to lose.

This detailed guide provides a comprehensive understanding of blockchain, from its mechanics to real-world applications. Blockchain’s potential extends far beyond cryptocurrencies, offering solutions in diverse industries while fostering trust, transparency, and innovation. For further exploration, visit authoritative resources like Investopedia, Stanford Online, and Simplilearn.